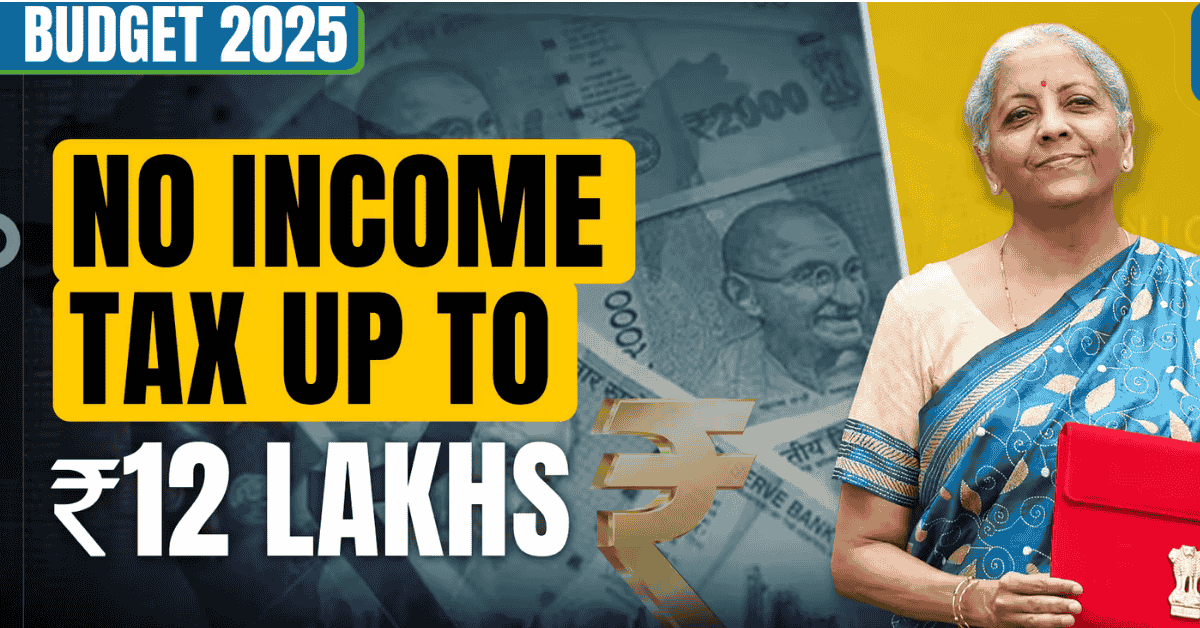

In a major announcement during the Union Budget 2025, Finance Minister Nirmala Sitharaman revealed that there would be no income tax on incomes up to ₹12 lakh under the new tax regime. This move is aimed at enhancing support for the middle class, reflecting the government’s commitment and trust in this segment of the population.

Effective Tax Relief for Incomes Up to ₹12.75 Lakh

Taking into account the previous standard deduction of ₹75,000, incomes up to ₹12.75 lakh will be exempt from income tax under the new regime. This effectively means that individuals earning up to ₹12 lakh annually will not have any tax liabilities.

Tax Slabs Revised for Middle-Class Relief

The Finance Minister elaborated on the revised tax slabs, which are designed to boost consumption and leave more money in the hands of the middle class. The new tax structure includes:

- No tax for incomes up to ₹4 lakh

- 5% tax for incomes between ₹4 lakh and ₹8 lakh

- 10% tax for incomes between ₹8 lakh and ₹12 lakh

- 15% tax for incomes between ₹12 lakh and ₹16 lakh

- 20% tax for incomes between ₹16 lakh and ₹20 lakh

- 25% tax for incomes between ₹20 lakh and ₹24 lakh

- 30% tax for incomes above ₹24 lakh

Tax Benefits for Middle-Class Taxpayers

The revised tax slabs will offer significant tax savings for taxpayers:

- A person earning ₹12 lakh annually will benefit from a tax reduction of ₹80,000.

- A person earning ₹18 lakh will see a tax benefit of ₹70,000.

- A person earning ₹25 lakh will enjoy a tax benefit of ₹1.10 lakh.

Sitharaman’s Eighth Consecutive Budget Presentation

This Union Budget marks Finance Minister Nirmala Sitharaman’s eighth consecutive Budget presentation, bringing her closer to the record held by former Prime Minister Morarji Desai, who presented ten Budgets during his lifetime.

The revisions in tax policy are expected to stimulate the economy by encouraging increased consumption and offering substantial relief to the middle class.

Here is the table showing the income tax benefit for taxpayers based on the provided data:

| Income (in lakh) | Present Tax | Proposed Tax | Difference Between Present & Proposed Tax | Rebate | Total Benefit |

|---|---|---|---|---|---|

| 8 | 30,000 | 20,000 | 10,000 | 20,000 | 30,000 |

| 9 | 40,000 | 30,000 | 10,000 | 30,000 | 40,000 |

| 10 | 50,000 | 40,000 | 10,000 | 40,000 | 50,000 |

| 11 | 65,000 | 50,000 | 15,000 | 50,000 | 65,000 |

| 12 | 80,000 | 60,000 | 20,000 | 60,000 | 80,000 |

| 13 | 1 Lakh | 75,000 | 25,000 | 0 | 25,000 |

| 14 | 1.2 Lakh | 90,000 | 30,000 | 0 | 30,000 |

| 15 | 1.4 Lakh | 1.05 Lakh | 35,000 | 0 | 35,000 |

| 16 | 1.7 Lakh | 1.2 Lakh | 50,000 | 0 | 50,000 |

| 17 | 2 Lakh | 1.4 Lakh | 60,000 | 0 | 60,000 |

| 18 | 2.3 Lakh | 1.6 Lakh | 70,000 | 0 | 70,000 |

| 19 | 2.6 Lakh | 1.8 Lakh | 80,000 | 0 | 80,000 |

| 20 | 2.9 Lakh | 2 Lakh | 90,000 | 0 | 90,000 |

| 21 | 3.2 Lakh | 2.25 Lakh | 95,000 | 0 | 95,000 |

| 22 | 3.5 Lakh | 2.5 Lakh | 1 Lakh | 0 | 1 Lakh |

| 23 | 3.8 Lakh | 2.75 Lakh | 1.05 Lakh | 0 | 1.05 Lakh |

| 24 | 4.1 Lakh | 3 Lakh | 1.1 Lakh | 0 | 1.1 Lakh |

| 25 | 4.4 Lakh | 3.3 Lakh | 1.1 Lakh | 0 | 1.1 Lakh |

This table summarizes the tax benefit calculations based on various income slabs.